Services

February 5, 2026

Amazon Ready to Scale Benchmarks

Services

February 5, 2026

Amazon Ready to Scale Benchmarks

Ready to Scale Benchmarks: Are You Actually Ready to Scale on Amazon?

Scaling on Amazon isn’t about spending more.

It’s about knowing when your account is structurally ready to absorb more ad spend without destroying profitability.

At Chrizon Agency, we see this mistake constantly:

brands pushing budgets up because “ACoS looks good” — and then wondering why growth stalls or margins disappear.

That’s why we use Ready to Scale Benchmarks.

Not as vanity metrics.

As decision-making filters.

What Does “Ready to Scale” Really Mean?

Being ready to scale means one thing:

You can increase spend while maintaining control over performance, efficiency, and conversion.

If any of the foundations below are weak, scaling only magnifies problems.

That’s where benchmarks come in.

The Core Ready to Scale Benchmarks

(Insert image here – Ready to Scale Benchmarks by Chrizon Agency)

These are the baseline indicators we look for before recommending aggressive scaling.

1. Conversion Rate (CVR)

Benchmark:

10%–15% minimum (category dependent)

Why it matters:

You cannot outbid competitors sustainably if your listing doesn’t convert.

Low CVR = paid traffic leak.

Before scaling PPC, your listing must already be doing its job:

Clear positioning

Strong main image

Optimized copy

Relevant traffic

Scaling ads won’t fix a weak listing — it will only expose it faster.

2. ACoS Stability (Not Just “Low ACoS”)

Benchmark:

Stable ACoS across multiple weeks

Predictable performance, not spikes

A low ACoS alone is not a green light.

Low ACoS can mean:

Limited reach

Overly defensive targeting

Missed growth opportunities

What matters is control and consistency, not how pretty the number looks in isolation.

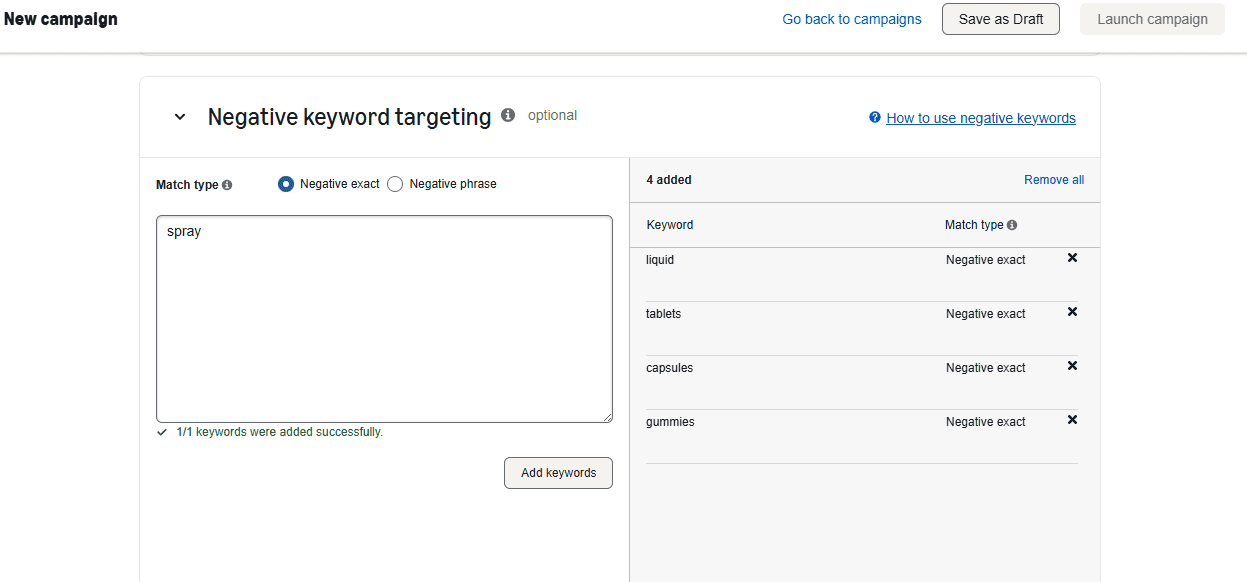

3. Keyword Coverage & Search Term Control

Benchmark:

Clear separation between:

Exact (defensive & scaling)

Phrase (expansion)

Broad / Auto (discovery)

If you can’t clearly answer:

Which keywords drive profit

Which keywords drive volume

Which ones are being mined

You’re not ready to scale — you’re guessing.

Scaling requires intentional traffic, not noise.

4. TACoS Trend

Benchmark:

Stable or declining TACoS while revenue grows

TACoS tells the real story of account health.

If revenue grows but TACoS climbs uncontrollably, you’re buying growth instead of building it.

Scaling should compound organic lift, not replace it.

5. Inventory & Operational Readiness

Benchmark:

Healthy inventory coverage

No frequent stockouts

Stable Buy Box

PPC doesn’t exist in a vacuum.

Scaling ads without inventory planning kills momentum, ranking, and efficiency.

Amazon punishes inconsistency.

Why These Benchmarks Matter Before Scaling

Because Amazon rewards systems, not reactions.

When these benchmarks are met:

Budget increases become predictable

Bid adjustments make sense

Performance remains readable

Growth becomes repeatable

When they aren’t:

You chase metrics

You react emotionally

You burn spend

You stall growth

How Chrizon Agency Uses These Benchmarks

We don’t scale because a client wants to scale.

We scale when the account earns the right to scale.

Our process:

Validate structural readiness

Fix bottlenecks

Align PPC with listing & inventory

Scale in controlled layers

Measure impact at account level (not campaign vanity metrics)

That’s how brands grow without losing control.

Final Thought for Amazon Sellers

If you’re asking:

“Why can’t I scale even though my ACoS is low?”

The answer is usually here — in the benchmarks you’re not tracking yet.

Growth on Amazon isn’t aggressive.

It’s disciplined.

Want to Know If Your Account Is Ready to Scale?

At Chrizon Agency, we analyze accounts through this exact framework before touching budgets.

If you want clarity before spending more,

let’s talk.

Ready to Scale Benchmarks: Are You Actually Ready to Scale on Amazon?

Scaling on Amazon isn’t about spending more.

It’s about knowing when your account is structurally ready to absorb more ad spend without destroying profitability.

At Chrizon Agency, we see this mistake constantly:

brands pushing budgets up because “ACoS looks good” — and then wondering why growth stalls or margins disappear.

That’s why we use Ready to Scale Benchmarks.

Not as vanity metrics.

As decision-making filters.

What Does “Ready to Scale” Really Mean?

Being ready to scale means one thing:

You can increase spend while maintaining control over performance, efficiency, and conversion.

If any of the foundations below are weak, scaling only magnifies problems.

That’s where benchmarks come in.

The Core Ready to Scale Benchmarks

(Insert image here – Ready to Scale Benchmarks by Chrizon Agency)

These are the baseline indicators we look for before recommending aggressive scaling.

1. Conversion Rate (CVR)

Benchmark:

10%–15% minimum (category dependent)

Why it matters:

You cannot outbid competitors sustainably if your listing doesn’t convert.

Low CVR = paid traffic leak.

Before scaling PPC, your listing must already be doing its job:

Clear positioning

Strong main image

Optimized copy

Relevant traffic

Scaling ads won’t fix a weak listing — it will only expose it faster.

2. ACoS Stability (Not Just “Low ACoS”)

Benchmark:

Stable ACoS across multiple weeks

Predictable performance, not spikes

A low ACoS alone is not a green light.

Low ACoS can mean:

Limited reach

Overly defensive targeting

Missed growth opportunities

What matters is control and consistency, not how pretty the number looks in isolation.

3. Keyword Coverage & Search Term Control

Benchmark:

Clear separation between:

Exact (defensive & scaling)

Phrase (expansion)

Broad / Auto (discovery)

If you can’t clearly answer:

Which keywords drive profit

Which keywords drive volume

Which ones are being mined

You’re not ready to scale — you’re guessing.

Scaling requires intentional traffic, not noise.

4. TACoS Trend

Benchmark:

Stable or declining TACoS while revenue grows

TACoS tells the real story of account health.

If revenue grows but TACoS climbs uncontrollably, you’re buying growth instead of building it.

Scaling should compound organic lift, not replace it.

5. Inventory & Operational Readiness

Benchmark:

Healthy inventory coverage

No frequent stockouts

Stable Buy Box

PPC doesn’t exist in a vacuum.

Scaling ads without inventory planning kills momentum, ranking, and efficiency.

Amazon punishes inconsistency.

Why These Benchmarks Matter Before Scaling

Because Amazon rewards systems, not reactions.

When these benchmarks are met:

Budget increases become predictable

Bid adjustments make sense

Performance remains readable

Growth becomes repeatable

When they aren’t:

You chase metrics

You react emotionally

You burn spend

You stall growth

How Chrizon Agency Uses These Benchmarks

We don’t scale because a client wants to scale.

We scale when the account earns the right to scale.

Our process:

Validate structural readiness

Fix bottlenecks

Align PPC with listing & inventory

Scale in controlled layers

Measure impact at account level (not campaign vanity metrics)

That’s how brands grow without losing control.

Final Thought for Amazon Sellers

If you’re asking:

“Why can’t I scale even though my ACoS is low?”

The answer is usually here — in the benchmarks you’re not tracking yet.

Growth on Amazon isn’t aggressive.

It’s disciplined.

Want to Know If Your Account Is Ready to Scale?

At Chrizon Agency, we analyze accounts through this exact framework before touching budgets.

If you want clarity before spending more,

let’s talk.

Ready to Scale Benchmarks: Are You Actually Ready to Scale on Amazon?

Scaling on Amazon isn’t about spending more.

It’s about knowing when your account is structurally ready to absorb more ad spend without destroying profitability.

At Chrizon Agency, we see this mistake constantly:

brands pushing budgets up because “ACoS looks good” — and then wondering why growth stalls or margins disappear.

That’s why we use Ready to Scale Benchmarks.

Not as vanity metrics.

As decision-making filters.

What Does “Ready to Scale” Really Mean?

Being ready to scale means one thing:

You can increase spend while maintaining control over performance, efficiency, and conversion.

If any of the foundations below are weak, scaling only magnifies problems.

That’s where benchmarks come in.

The Core Ready to Scale Benchmarks

(Insert image here – Ready to Scale Benchmarks by Chrizon Agency)

These are the baseline indicators we look for before recommending aggressive scaling.

1. Conversion Rate (CVR)

Benchmark:

10%–15% minimum (category dependent)

Why it matters:

You cannot outbid competitors sustainably if your listing doesn’t convert.

Low CVR = paid traffic leak.

Before scaling PPC, your listing must already be doing its job:

Clear positioning

Strong main image

Optimized copy

Relevant traffic

Scaling ads won’t fix a weak listing — it will only expose it faster.

2. ACoS Stability (Not Just “Low ACoS”)

Benchmark:

Stable ACoS across multiple weeks

Predictable performance, not spikes

A low ACoS alone is not a green light.

Low ACoS can mean:

Limited reach

Overly defensive targeting

Missed growth opportunities

What matters is control and consistency, not how pretty the number looks in isolation.

3. Keyword Coverage & Search Term Control

Benchmark:

Clear separation between:

Exact (defensive & scaling)

Phrase (expansion)

Broad / Auto (discovery)

If you can’t clearly answer:

Which keywords drive profit

Which keywords drive volume

Which ones are being mined

You’re not ready to scale — you’re guessing.

Scaling requires intentional traffic, not noise.

4. TACoS Trend

Benchmark:

Stable or declining TACoS while revenue grows

TACoS tells the real story of account health.

If revenue grows but TACoS climbs uncontrollably, you’re buying growth instead of building it.

Scaling should compound organic lift, not replace it.

5. Inventory & Operational Readiness

Benchmark:

Healthy inventory coverage

No frequent stockouts

Stable Buy Box

PPC doesn’t exist in a vacuum.

Scaling ads without inventory planning kills momentum, ranking, and efficiency.

Amazon punishes inconsistency.

Why These Benchmarks Matter Before Scaling

Because Amazon rewards systems, not reactions.

When these benchmarks are met:

Budget increases become predictable

Bid adjustments make sense

Performance remains readable

Growth becomes repeatable

When they aren’t:

You chase metrics

You react emotionally

You burn spend

You stall growth

How Chrizon Agency Uses These Benchmarks

We don’t scale because a client wants to scale.

We scale when the account earns the right to scale.

Our process:

Validate structural readiness

Fix bottlenecks

Align PPC with listing & inventory

Scale in controlled layers

Measure impact at account level (not campaign vanity metrics)

That’s how brands grow without losing control.

Final Thought for Amazon Sellers

If you’re asking:

“Why can’t I scale even though my ACoS is low?”

The answer is usually here — in the benchmarks you’re not tracking yet.

Growth on Amazon isn’t aggressive.

It’s disciplined.

Want to Know If Your Account Is Ready to Scale?

At Chrizon Agency, we analyze accounts through this exact framework before touching budgets.

If you want clarity before spending more,

let’s talk.

Blogs

Other Blogs

Check out our blogs for useful information for your Amazon business

Blogs

Other Blogs

Check out our blogs for useful information for your Amazon business

Blogs

Other Blogs

Check out our blogs for useful information for your Amazon business